Un Definition Of Money Laundering

The idea of money laundering is very important to be understood for those working in the financial sector. It's a course of by which soiled money is transformed into clean cash. The sources of the cash in precise are prison and the cash is invested in a manner that makes it appear to be clean money and conceal the id of the legal part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or sustaining present prospects the responsibility of adopting enough measures lie on each one who is a part of the organization. The identification of such element at first is easy to deal with as a substitute realizing and encountering such conditions in a while within the transaction stage. The central bank in any country supplies full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such conditions.

Along with some other aspects of underground economic activity rough estimates have been. The UN defines it as Money laundering is a process which disguises illegal profits without compromising the criminals who wish to benefit from the proceeds.

Money Laundering Crime Areas Europol

Money laundering has been a crime in the United States since 1986 making the United States one of the first countries to criminalise money laundering conduct.

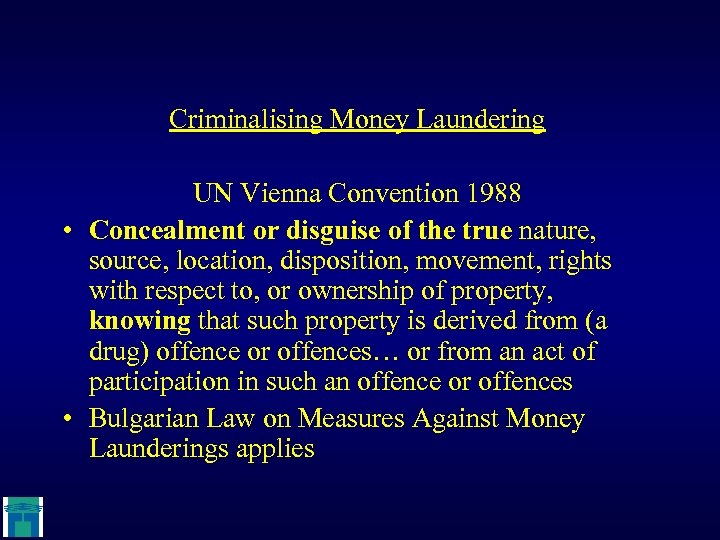

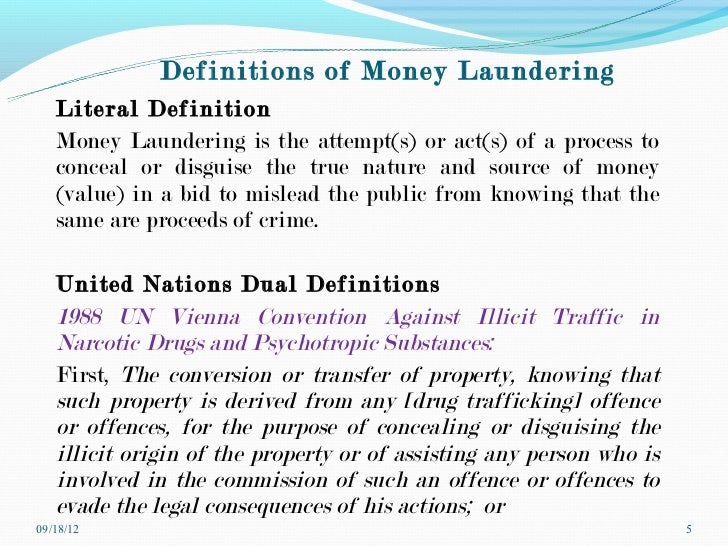

Un definition of money laundering. It is frequently a component of other much more serious crimes such as drug trafficking robbery or extortion. Money laundering is the process of transformation of criminal proceeds to disguise their illegal origin. The 1988 UN Vienna Convention.

About Business Crime Solutions - Money Laundering. A Coin or paper money of the United States or any other country that is designated as legal tender and that circulates and is customarily used and accepted as a medium of exchange in the country of issue. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. The FATF in 1990 gave a more inclusive definition. The initial impetus for co-ordinated international action to combat money laundering arose as has been noted out of a growing concern within the world community about the problems of drug abuse and illicit trafficking.

As Schneider and Windischbauer 2008 pointed out the term Money Laundering originates from the US describing the Mafias attempt to launder illegal money via cash-intensive washing salons which where controlled by company acquisitions or business formations. Its very easy to define but involves multiple techniques. And third making the money.

Money Laundering is an act of act of disguising the illegal source of income. B United States silver certificates United States Treasury notes and Federal Reserve System notes. Money Laundering is the process of changing the colors of the money.

Money laundering and the financing of terrorism are global problems that threaten the security and stability of financial institutions and systems undermine economic prosperity and weaken governance systems. A definition What is money laundering. Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources.

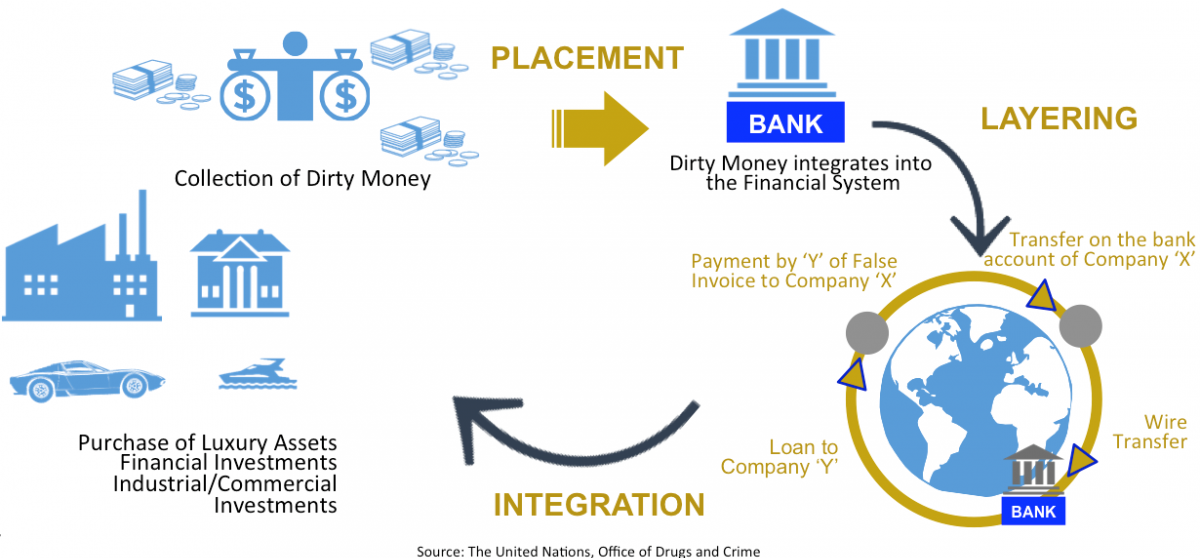

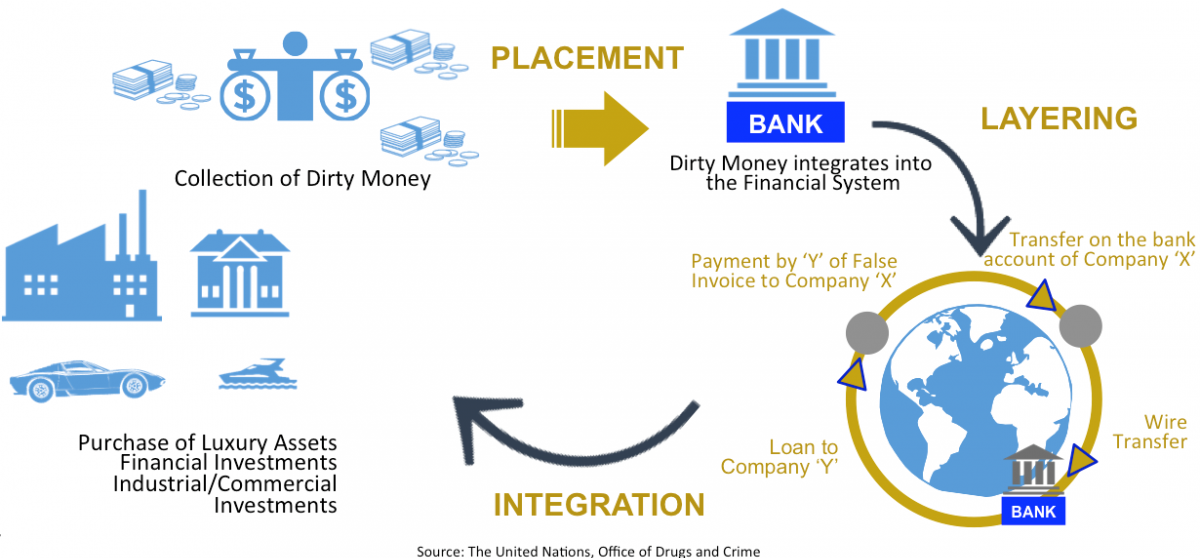

It is a dynamic three-stage process that requires. Money laundering is the processing of criminal proceeds to disguise their illegal origin. In order to prevent money laundering the UN Convention advises that governments establish a comprehensive domestic regulatory and supervisory regime for financial institutions.

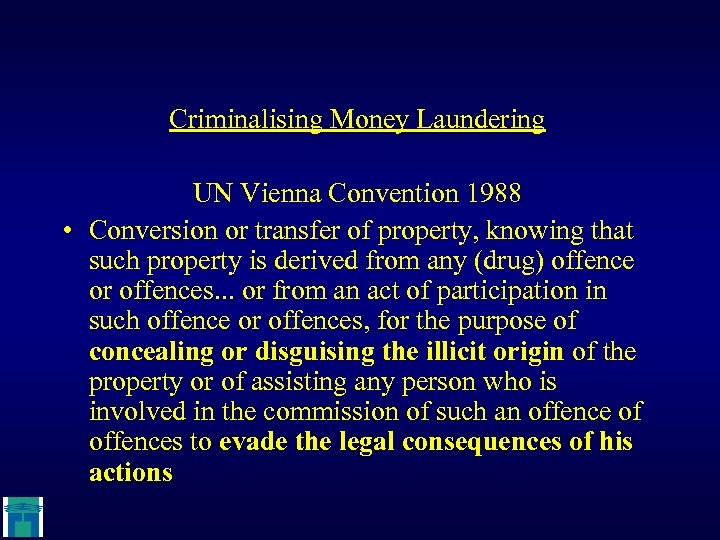

Worldwide Financial Intelligence Units FIUs play a leading role in the prevention of anti-money laundering and counter-terrorist. Money laundering has been addressed in the UN Vienna 1988 Convention Article 31 describing Money Laundering as. The conversion or transfer of property knowing that such property is derived from any offense s for the purpose of concealing or disguising the illicit origin of the property or of assisting any person who is involved in such.

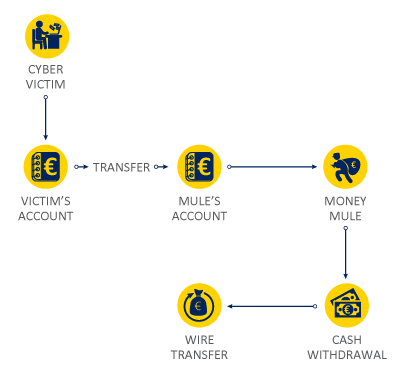

In addition to organised criminal groups professional money launderers perform money laundering services on. A Three-Stage Process Smurfs - A popular method used to launder cash in the placement stage. Similarly the International Monetary Fund IMF defines money laundering as a process by which the illicit source of assets or produced obtained by criminal activity.

First moving the funds from direct association with the crime. This process is of critical importance as it enables the criminal to enjoy these profits without jeopardising their sourceThrough the Global Programme UNODC encourages States to develop policies to counter money-laundering and the financing of terrorism. There are two money laundering criminal provisions 18 United States Code Sections 1956.

Money laundering is an offence in its own right but it is also closely related to other forms of serious and organised crime as well as the financing of terrorism. Second disguising the trail to foil pursuit. It further suggests that appropriate administrative regulatory law enforcement and other authorities should have the ability to cooperate and exchange information at both national and international levels.

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Money Laundering Meaning And Definition Tookitaki Tookitaki

Https Www Imolin Org Pdf Overview Of Un Conventions 2013 Pdf

Prevention Of Money Laundering Seminar On Financial Services

Prevention Of Money Laundering Seminar On Financial Services

Combating Money Laundering Terror Financing Case Of Nigeria Adv

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

What Is Money Laundering How Does It Occur What Are The Development Impacts Of Money Laundering Emiko Todoroki The World Bank Building Financial Market Ppt Download

Definition Of The Three Stages Of Money Laundering Money Laundering Regards The Financial Transactions In Which Individuals Participating In Criminal Activity Try To Disguise The Proceeds Or Sources From These Transactions

The world of regulations can look like a bowl of alphabet soup at times. US cash laundering rules aren't any exception. We've got compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on protecting financial companies by lowering danger, fraud and losses. We've got massive financial institution expertise in operational and regulatory danger. We've a powerful background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many antagonistic penalties to the group because of the dangers it presents. It increases the probability of main risks and the chance value of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment